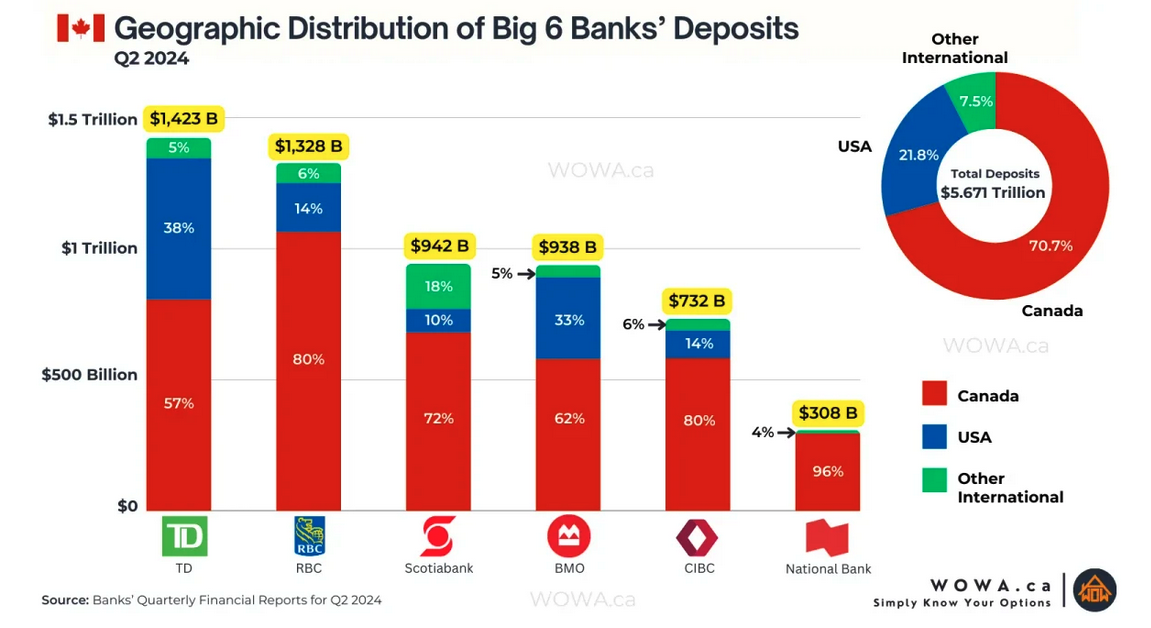

In case you're interested in the state of the Canadian banking landscape and geographic exposure, I just came across this chart, which seems useful that way.

All of them nickle and diming us on fees and services of course, but if you're worried about your savings and which bank is most exposed to the kleptocracy south of the border, TD is the worst and National the best, against that broad measure.