But the biggest factor in the meltdown was leverage. As prices dropped, leveraged positions were forcibly liquidated. This contributed to sell pressure, causing prices to go lower, triggering more liquidations. A classic crypto “death spiral”.

Cascading liquidations were worsened by crypto exchange glitches which left some customers watching helplessly as stop-losses failed to trigger or trades to add more collateral to at-risk positions failed to execute.

Though leverage is not unique to crypto, some things are: the extremely high leverage offered by some platforms (100x or more), the ability to use highly volatile cryptoassets as collateral, the speed at which positions can unwind, and limited requirements for position monitoring or risk management.

![Crypto’s generally illiquid markets contributed to the price volatility. CoinDesk reported that “market depth collapsed by more than 80% across major exchanges within minutes.”3 Market makers — institutions that normally provide liquidity and price stability by taking the opposite side of trades — came under fire as some accused them of amplifying the crash by withdrawing liquidity during this crucial period. The Coinwatch crypto tracking platform accused market makers of “desert[ing] their responsibility”,4 and blockchain analyst YQ alleged “they executed a coordinated withdrawal at the optimal moment to minimize their losses while maximizing subsequent opportunities.”5 Others characterized these institutions’ pullback as a normal risk management response to elevated volatility, and the predictable actions of firms with no mandate to maintain market stability at the expense of their trading books. Regardless of the reason, the severe lack of market depth resulted in extreme price dislocations across exchanges. On Binance, the Cosmos token momentarily appeared to plummet in value from $3.90 to a tenth of a cent.](https://media.hachyderm.io/media_attachments/files/115/391/603/259/896/059/original/5b364785efae8a18.png)

![Some have accused centralized exchanges of minimizing their own losses at their customers’ expense by intentionally halting trading or withdrawals under the guise of “technical difficulties”. Indeed, it is suspiciously common for supposedly highly sophisticated centralized exchanges to suddenly experience glitches or announce urgent “maintenance” under far less volatile circumstances. Kris Marszalek, founder of the Crypto.com centralized exchange, was among the most prominent to repeat this allegation, tweeting that regulators should investigate rival exchanges to determine if any “slow[ed] down to a halt, effectively not allowing people to trade”.6](https://media.hachyderm.io/media_attachments/files/115/391/610/467/231/273/original/cac2f004281ff652.png)

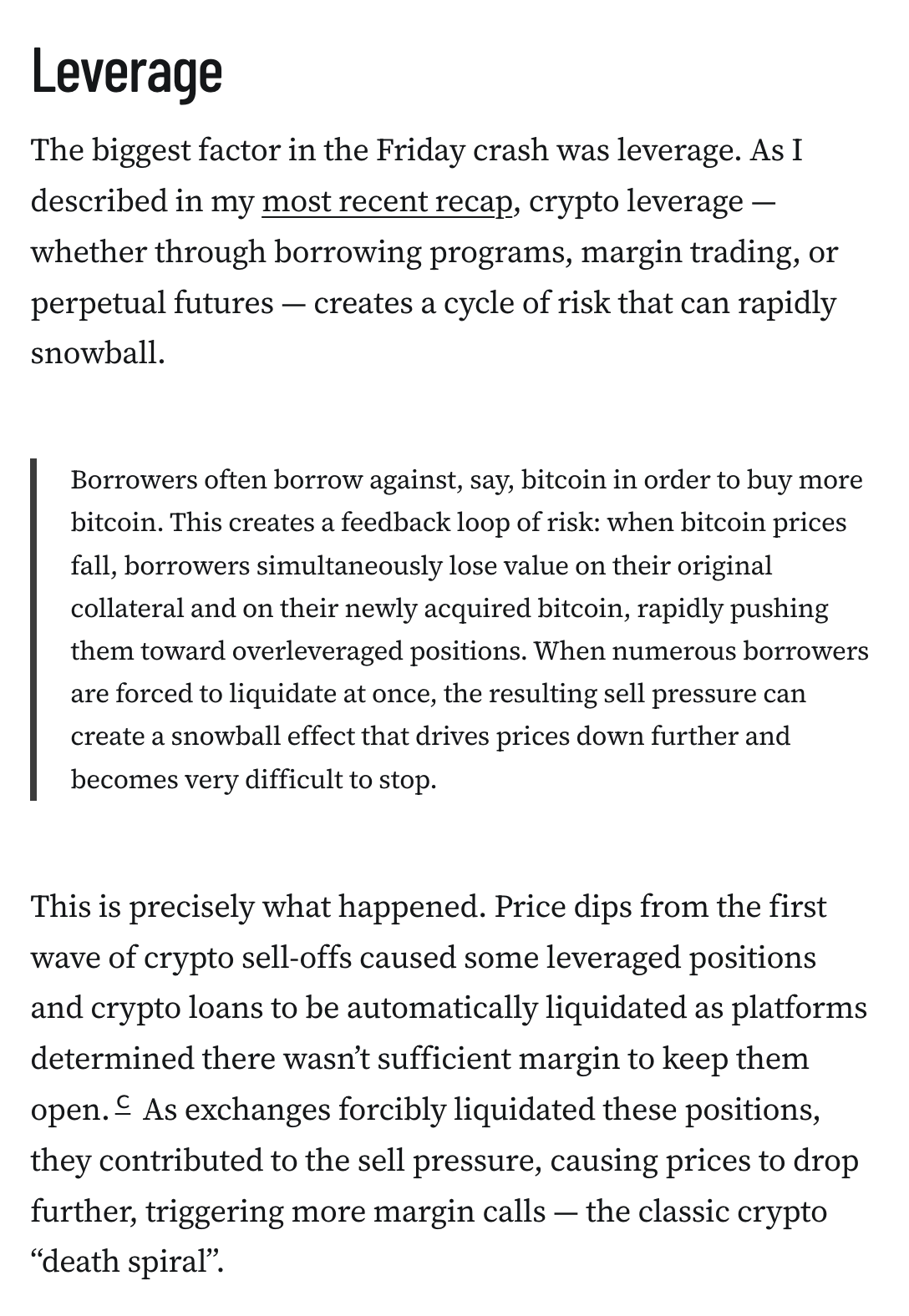

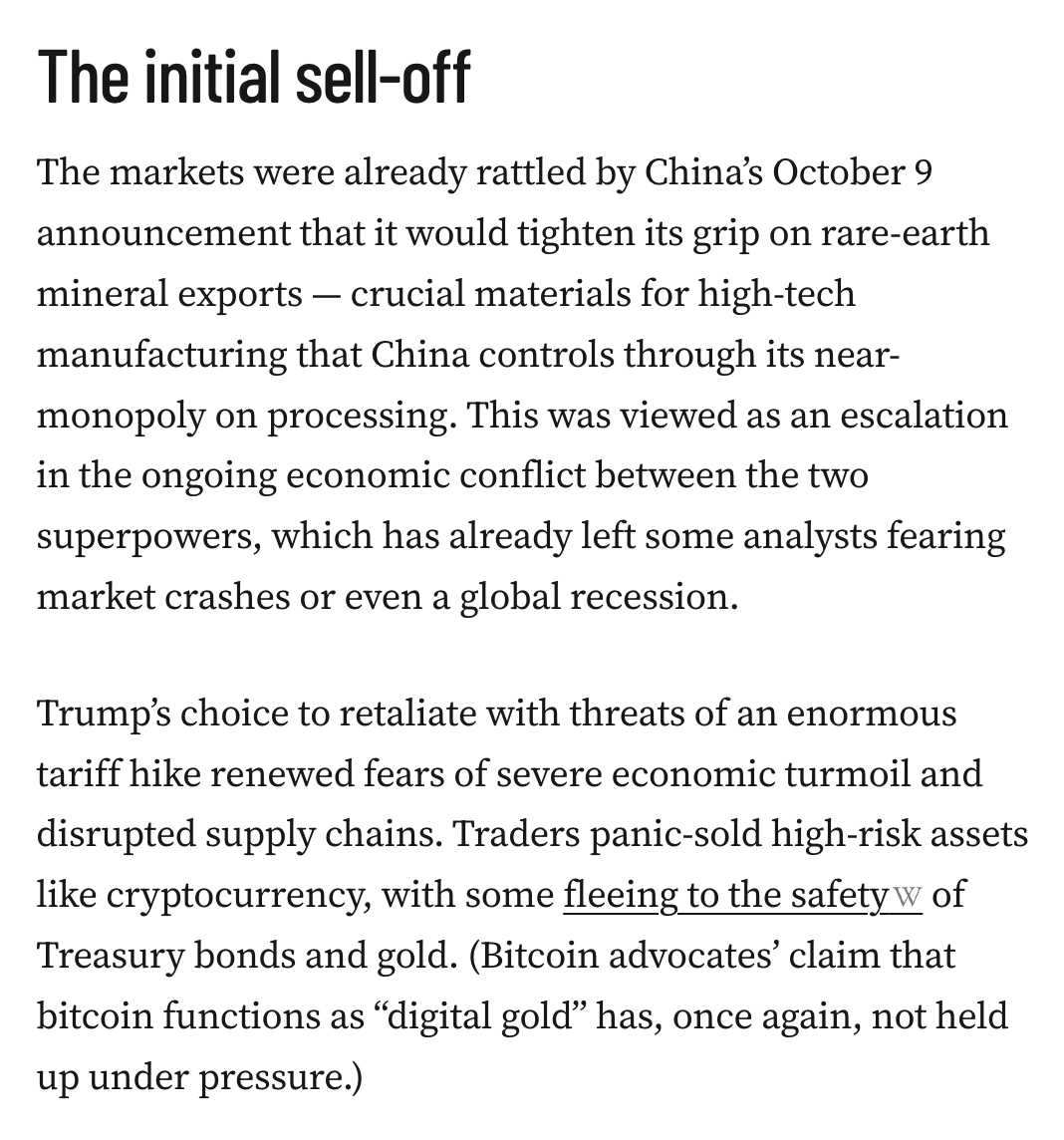

![During this crypto crash, exchanges began to blow through their insurance funds. Binance, for example, dipped into its insurance fund to the tune of around $188 million over just that one day.

A chart showing an insurance fund balance of around 1.2–1.25 billion, dropping to below $1.05 billion on October 10

Binance’s claimed insurance fund balance (Binance, geofenced)

And so multiple platforms resorted to auto-deleveraging. Among them was Hyperliquid, a buzzy defi trading platform, whose founder stated that “this was Hyperliquid’s first cross-margin ADL in more than 2 years of operation” and that “billions of dollars worth of positions [were] liquidated on Hyperliquid in a matter of minutes.”9 This helped stop the bleeding somewhat, and likely saved some exchanges from collapse. However, the early closures of short positions also removed even more orders from order books, thinning liquidity even further and potentially making it harder for markets to stabilize.](https://media.hachyderm.io/media_attachments/files/115/391/630/934/447/871/original/a676d303956901b6.png)